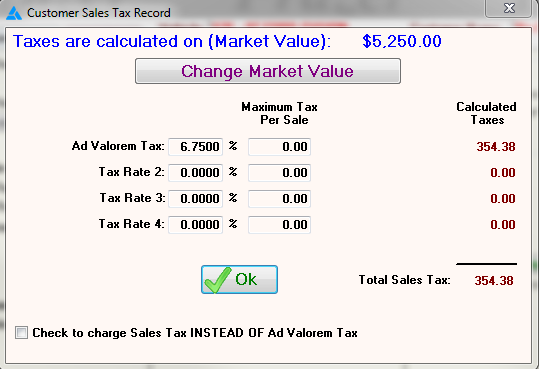

Ad valorem tax calculator

The most common ad valorem taxes are property. This calculator can also help estimate the tax due if a car is transferred from one.

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Purchases in excess of 1600 an.

. DOWNLOAD CURRENT TAVT ASSESSMENT MANUAL TITLE AD VALOREM TAX CALCULATOR. From commercial and residential real estate tax to personal. For a used motor vehicle not listed in the manual FMV is the value from the bill of sale or the.

Mississippi owners of vehicles with a Gross Vehicle Weight GVW of 10000 lbs or less must pay motor vehicle ad valorem taxes on their vehicles at the. State Sales Tax is 7 of purchase price less total value of trade in. Avalara AvaTax can help you automate sales tax rate calculation and filing preparation.

The ad valorem calculator can estimate the tax due when purchasing a vehicle of any sort. Vehicles purchased on or after March 1 2013 and titled in Georgia are subject to Title Ad Valorem Tax TAVT and are exempt from sales and use tax and the annual ad valorem tax. To figure the tax simply multiply.

Ad Valorem Tax. An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property. 35 contingency on residential 25 on commercial.

This comparison can then be used to see an. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. For another example lets say the property taxes on a home come to.

For purposes of assessment for ad valorem taxes taxable property is divided into five 5 classes and is assessed at a percentage of its true value as follows. Dallas County Property Tax Calculator. Motor Vehicle Ad Valorem Taxes.

Ad Get the benefit of tax research and calculation experts with Avalara AvaTax software. Dallas County Ad Valorem Tax Calculator. The millage rate also known as the tax rate is a figure applied to the value of your property to calculate your property tax liability.

However ad valorem taxes have the disadvantage of imposing taxes regardless of the cost to the taxpayer. This amount is never to exceed 3600. We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds.

Local Sales Tax is 225 of the first 1600. Ad valorem tax is a property tax not a use tax and follows the property from owner to owner. One mill equals one dollar of tax on every thousand.

You may visit the Title Ad Valorem Tax Calculator to compare the current annual ad valorem tax and the new one-time Title Fee. This calculator uses 2021 rates derived from the Dallas County Appraisal District DCAD website. The TAX RATE for each county and municipality is set by the mayor and the legislative body of the counties and municipalities based on the amount budgeted to fund services.

Therefore unlike registration fees taxes accumulate even when a vehicle is not used on the. The ASSESSED VALUE is 25000 25 of 100000 and the TAX RATE has been set by your county commission at 320 per hundred of assessed value. The most common ad valorem taxes are property taxes levied on.

An ad valorem tax is based on the assessed value of an item such as real estate or personal property.

Property Tax Calculator Property Tax Guide Rethority

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

Understanding California S Property Taxes

Calculating Personal Property Tax Youtube

Tax Rates Gordon County Government

The Property Tax Equation

Township Of Nutley New Jersey Property Tax Calculator

Real Estate Property Tax Constitutional Tax Collector

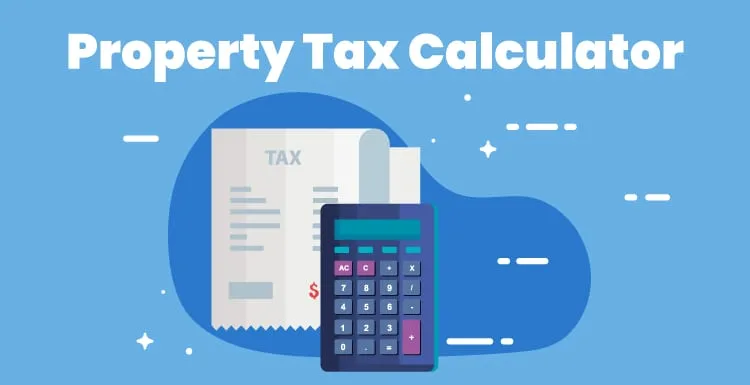

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease

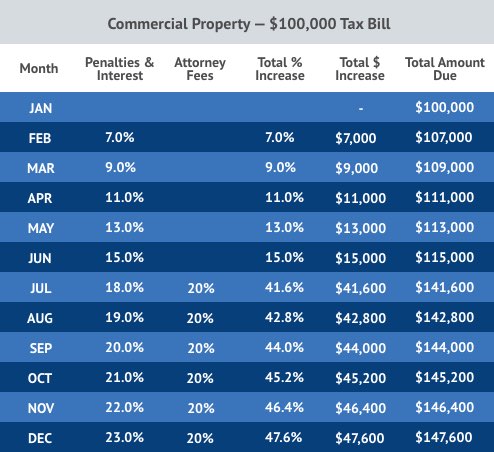

Excise Tax Definition Types Calculation Examples

Car Tax By State Usa Manual Car Sales Tax Calculator

Property Tax Calculator

New York Property Tax Calculator 2020 Empire Center For Public Policy

Property Tax Calculator Property Tax Guide Rethority

Property Tax Calculator

Total Tax A Suggested Method For Calculating Alcohol Beverage Taxes Apis Alcohol Policy Information System

Frazer Software For The Used Car Dealer State Specific Information Georgia